How to Effectively Source Private Equity Opportunities

When it comes to understanding how to find companies for acquisition, a clearly defined strategy is essential. Last year alone, more than 4,000 companies were acquired by private equity firms at an average of $1 billion each.

Finding quality deals is vital to staying competitive, and you need to make quick, conclusive decisions when faced with the question, “Should I invest in private equity opportunity A or B?”

Fortunately, we have some great tips on not only how to find a business for sale but the right companies to buy. Before we dive in, let’s cover some of the fundamentals of landing the best private equity opportunities and how to leverage the latest innovations in sourcing companies to buy faster and more efficiently than ever before.

3 Traditional Ways to Find Companies to Buy

Before you can strategize how to buy out a company, you need to source the right opportunities. Here are three traditional ways to find companies to buy.

1. Databases and Directories

PE firms searching for companies to buy often use databases and directories as the first point of reference. Directories and databases contain information on businesses that are for sale, such as:

- Size (employee count)

- Years in business

- Revenue

While databases and directories may be one of the go-to methods of how to find companies for acquisition, the biggest disadvantages are the inordinate amount of time spent manually sifting through and making sense of information and the risk that the data is stale and no longer accurate.

2. Third-party Business Brokers

When wondering how to find a business for sale or how to find out about mergers and acquisitions, business brokers have been a definitive resource to lean on. Brokers create relationships with private equity firms and successful business owners to help connect buyers with sellers who meet their specific criteria.

Though brokers create a more personalized buying experience for PE firms, using business brokers can get expensive as they generally charge high finder’s fees or commissions for the private equity opportunities they source.

3. In-house Teams

Having an in-house team dedicated to deal sourcing is another traditional way PE firms identify companies to buy. While this method can be effective, the only way to scale it is by constantly increasing headcount, which is costly. In addition, unlike business brokers who are compensated on a transaction basis, an in-house team’s payroll increases a firm’s fixed operating expenses regardless of whether they find target acquisitions.

How to Find Companies for Acquisition With udu

While the conventional methods above work, their efficiency, and effectiveness diminish as new technologies emerge. In addition, traditional deal sourcing strategies are time-consuming, labor-intensive, and expensive, posing even more challenges for smaller or new PE firms.

That’s why more and more private equity firms are turning to AI for deal sourcing to find the best opportunities. Deal sourcing tools help PE firms quickly identify, analyze, and conduct due diligence on potential deals. If you’re wondering how to find companies for acquisition, meet udu: an AI-powered deal sourcing platform for private equity. Here’s how it works—

1. Input your specific acquisition criteria.

First, define the parameters of what you’re looking for in a deal. You can make your search criteria as broad or as granular as necessary.

2. udu will find private equity opportunities that match your criteria.

Once you input your acquisition criteria, udu searches through countless data sources to find the best matches. Rather than relying on a team of analysts, AI technology can do the work in a fraction of the time, uncovering private equity opportunities humans may have missed. Plus, AI never needs a break, so your searches are always running, even when your team is out of the office.

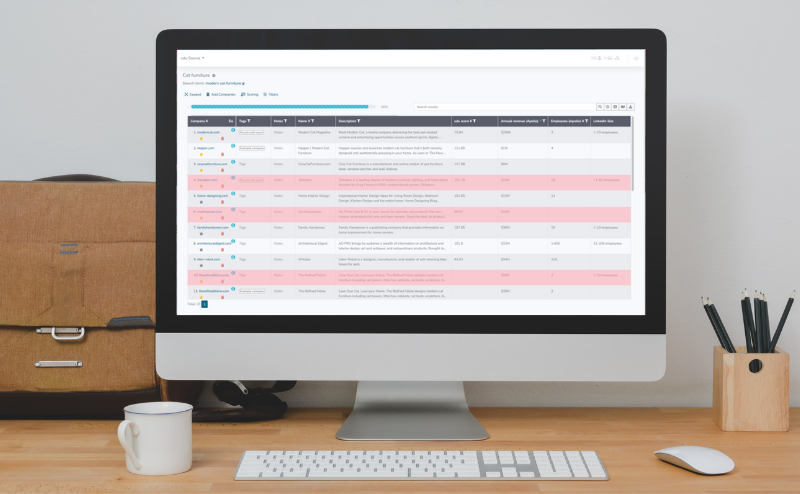

3. udu sources, sorts, and scores the best opportunities.

Our tool scores and ranks the best matches for your company, ensuring you only receive the most relevant results.

4. Review the results.

Now, it’s up to you to review the best private equity opportunities and decide which ones to pursue.

5. Complete due diligence and (potentially) close the deal.

Once you’ve found a match, it’s time to perform your due diligence. udu provides competitive intelligence and insights that give your analysts and key decision-makers the ability to make smarter decisions faster.

Find the Best Companies to Buy With udu

Private equity firms increasingly turn to AI-driven deal sourcing to more quickly and effectively find acquisition opportunities. With udu’s AI deal sourcing platform, PE firms can easily:

- Streamline their deal sourcing process

- Source deals faster and with more precision

- Uncover hidden signals and overlooked opportunities

- Leverage deeper insights in decision-making

- Make decisions more quickly, accurately, and aggressively

- Take a scalable, always-on approach to deal sourcing

If you’re wondering how to find companies for acquisition, the answer lies within udu’s industry-leading AI deal sourcing solution. Simply input your parameters, and udu will do the rest. With udu, you can quickly create a shortlist of the best private equity opportunities that match your acquisition criteria without the limitations of traditional deal sourcing methods.

Ready to get started? Contact udu today to schedule your free demo and discover why so many private equity firms are turning to AI deal sourcing to find the best companies to buy.