3 Private Equity Deal Sourcing Strategies

How do private equity firms (PE) find companies to buy? Do they follow a deal sourcing strategy or other private equity strategies?

The past several years have seen a boom in private equity acquisitions: In 2021, total deal values exceeded $1 trillion for the first time.

There are various private equity strategies, with virtually every firm taking a slightly different approach to investments and acquisitions. So, how do private equity firms source deals?

Well, it’s no secret that proprietary deal flow is vital to a private equity firm’s long-term viability. In this article, we’ll explore:

- The keys to private equity deal sourcing

- The typical life cycle of a private equity fund

- The typical life cycle of a PE deal

- What types of companies are acquired by private equity firms

- How to build a sustainable deal sourcing strategy

- The importance of due diligence and implementing key private equity strategies to find the right companies

What’s the Life Cycle of a Private Equity Fund?

To understand private equity deal sourcing, we first have to answer a fundamental question: How does a private equity deal work?

The typical life cycle of a private equity fund is 10 years. The first five years are the investment period and then up to five more years to exit investments and return capital to investors. Individual PE deals typically last 6 years and can be broken down into three general phases: analyze, operate, and exit.

1. Analyze

During the analysis phase, a PE firm identifies potential investments and conducts due diligence to assess a business’s viability and potential. In this phase, the firm is mainly looking for companies with the potential for growth and profitability.

2. Operate and Monitor

Once an investment is made, the firm enters the operating phase. The approach to this phase may differ, but, generally speaking, all PE firms work to grow the business and make it more profitable. Operational adjustments might include acquiring other smaller companies, implementing new sales strategies, improving workflows and productivity, and building management depth.

3. Exit

In the exit phase, the private equity firm sells the business – or its stake in it – or helps the company prepare for an initial public offering (IPO). Some firms opt for a “buy and hold” strategy instead of planning for a quicker exit. In this case, a PE firm focuses on generating long-term value for its investors. “Long-term” can mean anywhere from three years or more.

No matter what deal sourcing strategy a private equity firm employs, its ultimate goal is for every acquisition to create value for its investors.

How Do Private Equity Firms Find Companies?

Now that you know all about the life cycles of private equity funds and deals, let’s answer another fundamental question: How do private equity firms source deals?

When firms are looking for companies to invest in, they can use a few different private equity strategies. But building a solid deal sourcing strategy usually begins with a combination of the following:

1. M&A Intermediaries

One of the most common methods private equity firms use to find companies is through merger and acquisition (M&A) intermediaries. M&A intermediaries are professionals who specialize in connecting corporate buyers and sellers.

Working with an M&A intermediary gives a private equity firm access to a wide range of potential deals. It also takes some of the due diligence work off of the firm’s plate as the intermediary finds and evaluates the company before developing the marketing materials and related due diligence information.

2. Deal Sourcing Tools

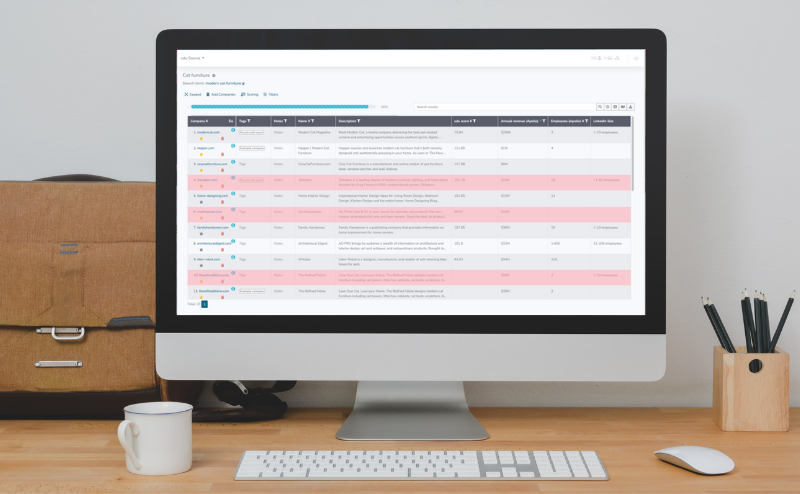

Another popular method for finding companies is using private equity deal sourcing tools. These tools allow private equity firms to search for companies that match specific investment criteria. An AI-powered tool like udu can quickly identify potential acquisition targets that go unnoticed by human searches.

3. Industry Referrals

Increasingly, PE firms are focusing on a smaller number of industry verticals. This focus can build deeper industry networks and help generate referrals that can also be a valuable source of leads. They can come from various sources, like other consultants, executive, private equity firms, investment bankers, and accountants. If a PE firm networks with these individuals and organizations, they might get their hands on a steady stream of potential deals.

3 Keys to Successful Private Equity Deal Sourcing

If you’re in the private equity business, you know that deal sourcing is critical. But how do private equity firms find companies that others might miss? And what does it take to succeed in private equity deal sourcing? Here are three key factors to keep in mind:

- Strategically evaluate companies. It’s not just about finding a deal; it’s about finding the right one. Weed out inferior opportunities by evaluating companies with a fine tooth comb to make room for better ones.

- Employ sector-specific strategies. A one-size-fits-all approach simply won’t cut it in this business. Instead, you must know each sector’s unique needs and challenges. Ideally, PE firms will focus their investments on one or a small number of sectors.

- Use the right tools. Private equity deal sourcing is fast-paced, and you can’t afford to waste time on inefficient processes. The right tools (e.g., an AI-powered deal sourcing platform) will help you streamline your deal sourcing process so you can find better investment opportunities quickly.

Enhance Your Private Equity Deal Sourcing With udu

How do private equity firms find companies to invest in? There are various methods to source deals, as discussed, but the most successful PE firms:

- Strategically evalue potential investments

- Focus their efforts on specific sectors

- Use modern tools to improve their deal sourcing process

If you want to streamline your private equity strategies, udu can give you the upper hand. As an industry-leading deal sourcing tool, udu enables PE firms to access less competitive, proprietary deal candidates using AI and machine learning. udu makes finding the right companies easy. Request a demo to learn more about udu and how our team of experts can support your private equity deal sourcing strategies.