5 Ways to Capitalize on Deal Sourcing Strategies

Private equity (PE) firms must work efficiently and effectively to secure profitable deals within the competitive landscape. Yet, many overlook key private equity deal sourcing strategies that can significantly impact their success.

Recent stats show an increasing number of private equity firms or investment vehicles in the U.S. 2023 estimates are coming in at 13,814, an increase of 2% from the previous year. This means identifying and capitalizing on deal sourcing strategies is even more critical.

So, how do private equity firms find deals ahead of their competition? Keep reading to discover five deal sourcing strategies that can help firms secure attractive investments.

Sourcing Deals: What’s the Deal Sourcing Process?

First, let’s take a look at the private equity deal sourcing process.

Deal sourcing describes the process of sourcing, vetting, and negotiating deals for investments or acquisitions. A private equity firm must know exactly what types of investments are most desirable so they can quickly differentiate opportunities.

PE deal sourcing typically follows a series of steps to get a comprehensive assessment of each potential opportunity.

Step 1: Research

The first step of the PE deal sourcing process is research. Firms conduct a thorough analysis of an opportunity to ensure it meets desired criteria that can include profitability, liquidity, risk profile, and long-term growth potential. A deal sourcing platform that provides greater access to data can increase a firm’s accuracy and speed up the research process.

Step 2: Screening

The second step of the PE deal sourcing process is screening, which involves narrowing down the list of potential investments by assessing each opportunity’s viability and risk profile. Here are some factors firms should consider during the screening phase:

- Financial standing

- Leadership style

- Competitive landscape

- Potential for growth

These only represent a few ways that firms can analyze a business.

Step 3: Negotiating and Closing

If the deal passes the screening phase, the final step is negotiating, going to contract, and closing. This step involves agreeing on specified terms, executing contracts, and completing legal paperwork.

5 Private Equity Deal Sourcing Strategies

Once you understand the deal sourcing process and have a set of sourcing best practices, it’s time to take action. Here are five private equity deal sourcing strategies to help you secure attractive investments.

Strategy 1: Develop a Company Identity

Before you start sourcing deals, your private equity firm should develop a clear and consistent identity. It can be challenging to attract deals that meet your criteria without knowing what your firm stands for and the type of investments you want in your portfolio.

Developing a company identity should include:

- Defining your purpose

- Establishing core values

- Identifying target investments and industries

- Building relationships with key partners

When you can clearly articulate your firm’s purpose and values, you’ll be better positioned to attract deals that fit your parameters.

Strategy 2: Recruit the Services of Business Development Experts

Employing a team of professionals specializing in deal sourcing can help you identify potential deals faster and more efficiently. Business development professionals have valuable industry connections and experience that can help firms find the right investments.

Not only can these experts identify key performance indicators (KPIs), but they can help streamline business operations. This is imperative for firms that have access to proprietary deal flow networks, as PE firms must be able to obtain and process data in a timely manner accurately.

Strategy 3: Monitor Signs of Economic Growth or Changing Trends

Best practices on how to find private equity deals always involve research, but certain signs can help you identify potential opportunities quickly. Keep a close eye on the news for any indications of an impending economic boom or changing trends in your target industries – this could signal the potential for new deals and investments.

Stay up-to-date on relevant industry and market reports from reliable sources. This is a great way to spot changes or trends before they’re widely known, giving you a head start in the PE deal sourcing process.

Strategy 4: Segment Deals

How do private equity firms find deals that actually close? One way is segmenting your deal flow, so it helps you narrow down the best opportunities.

For example, you can segment deals by stage of development, size, location, or industry. Segmenting makes it easier to identify the most attractive investments quickly and efficiently. You can also use a private equity deal sourcing platform to create filters that segment deals automatically. These segments can notify you when new deals that fit your criteria get added.

Strategy 5: Use Advanced AI or Machine Learning

One of the most significant developments in sourcing deals involves advanced AI and machine learning. This technology can automate finding private equity deals and eliminate much of the manual effort involved in traditional deal sourcing.

Machine learning algorithms can quickly scan for potential investments, allowing you to identify opportunities your team might have overlooked or even missed. Plus, these systems can often provide deeper insights into the deal than manual analysis.

How to Identify the Best Private Equity Deal Sourcing Platform for Your Firm

The private equity deal sourcing strategies listed above are key to finding the best investments for your firm, but you’ll need the right platform to support these strategies. A powerful deal sourcing platform offers a range of features and capabilities that make it easier to identify, track and review potential investments.

When looking for a private equity deal sourcing platform, consider the following:

Does the Deal Sourcing Platform Have Access to Proprietary Deal Flow Networks?

A proprietary deal flow network can give you access to investments that might not be available on other platforms. Given the competitive nature of the market, it’s important that PE firms can access valuable information before other major players. Having a wide range of information can help firms identify whether a company is truly a potential investment opportunity.

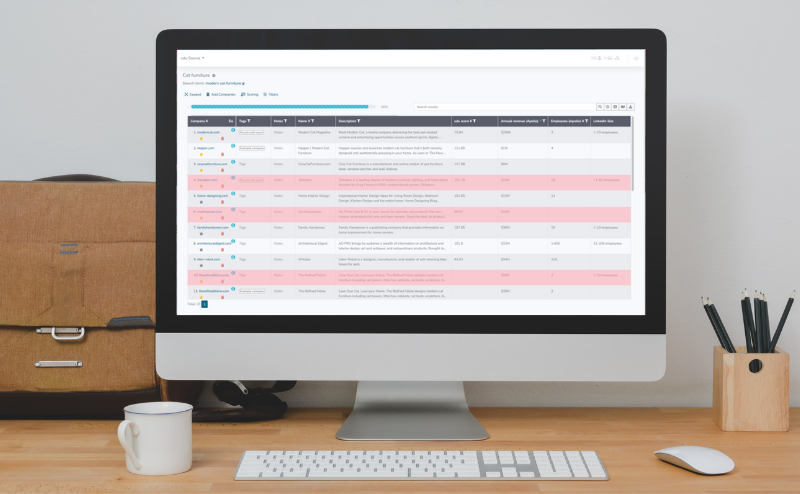

Does the Deal Sourcing Platform Offer Segmentation and Filtering Tools?

Finding potential investment opportunities is similar to finding a needle in a haystack – they can be nearly impossible to locate. Look for a platform that has powerful segmentation and filtering tools so you can quickly narrow down potential investments according to your specified criteria. This will help weed out irrelevant data and ensure that the correct parameters are adhered to.

Does the Deal Sourcing Platform Use AI and Machine Learning?

Look for a platform that offers advanced AI and machine learning capabilities – this technology can significantly streamline the deal sourcing process. AI can quickly scan for opportunities and provide deeper insights than manual analysis. This allows your team to focus on the more complex aspects of deal-making.

Understanding these private equity deal sourcing strategies and using the right deal sourcing platform can make a big difference in finding the right opportunities. So, what is the best deal sourcing platform?

Learn How to Find Private Equity Deals Using an AI-powered Deal Sourcing Platform

At udu, our deal sourcing platform harnesses the power of machine learning and natural language processing, enabling PE firms to make smarter decisions faster. Unlike a human analyst, udu is trained to identify and screen company data, isolating matches to your unique criteria 24/7—no coffee breaks needed.

Schedule a demo today to see how our platform can generate proprietary deal flow and improve your private equity deal sourcing strategies.