5 Benefits of Private Equity Data Science Tools

Companies are constantly looking to increase their revenue streams and profitability, while investors are always looking for promising businesses with the potential to provide them with a healthy return on investment.

Private equity is a great way to merge these two concepts. However, as the deal volume in private equity markets continues to rise – $512 billion in first half of 2022 alone – identifying advantageous deals has become a challenge.

Simple business analysis and spreadsheets are a thing of the past as data science in private equity has become more prominent in the industry. Recent surveys found that over 90% of private equity firms believe AI will likely have the biggest transformational impact on the sector.

How can the evolution of data science in private equity help your business? And what steps should you take to ensure that private equity data management is at the forefront of your investment strategy?

How Private Equity Data Management Plays a Critical Role in Firm Analysis

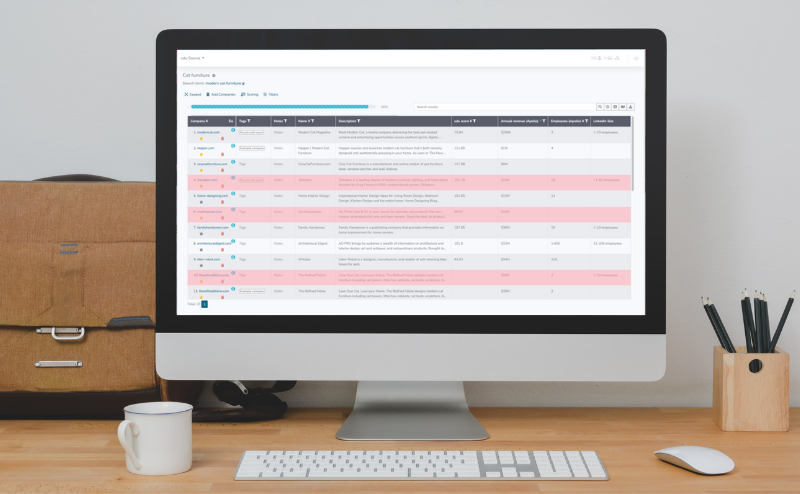

Private equity data science’s capabilities have vastly improved, allowing firms to understand the performance of their investments better and gain an edge. Today, firms can use private equity data management – including tools like machine learning, natural language processing, and quantitative modeling – to scrutinize company information for insights into potential investments.

High-value data points related to pricing, business insights, consumer credit, sentiment, reviews and ratings, mobile app usage, and other open data can be stored in a centralized location. And as information becomes more readily available, firms need to be able to sift through all that data to find meaningful connections and correlations efficiently. When they do, they can get a more comprehensive analysis of investment opportunities.

Advantages of Using a Data Analytics Private Equity Tool

Robust private equity data science tools can help you find proprietary deals before the competition gets wind of them. Using private equity analytics software to screen potential investments has many advantages – here are five of them.

1. Increased Accuracy in Projecting ROI

The potential for identifying attractive investment opportunities can be maximized by using data to forecast the potential returns of a portfolio accurately. Private equity data science provides an understanding of the company’s historical performance, expected growth rates, and other risk factors that could affect an investment’s success or failure. By combining machine learning and predictive analytics, PE firms can better identify the characteristics of businesses that make for successful investments.

2. Identify Attractive Deals Faster

Data analytics in private equity allows for quicker analysis of potential investments, helping firms identify deals much faster. By leveraging data-driven insights, investors can make more informed decisions in less time and potentially secure proprietary deals before the competition.

3. Improved Decision-making During Complex Deals

With data analytics, private equity firms can draw from the insights generated by data science, greatly improving their decision-making. Decisions based on data are more reliable because they account for facts and figures rather than relying on intuition or gut feelings. This data-backed approach often results in greater consistency and fewer mistakes.

4. More Efficient Use of Resources

Using a tool to unlock the possible applications of data science in private equity can help firms use their resources more efficiently. By leveraging the insights offered by artificial intelligence, firms can save time and money that would have otherwise been spent on manual research and analysis.

5. Access to Relevant and Targeted Data

Using data science can give firms better access to relevant information and help them gain valuable insights about their investments. With the help of AI, firms can identify patterns or trends in real-time. Imagine identifying a potential target for investment in the early stages of its development – before it gets saturated with investors. A private equity data management tool can make this possible.

How to Choose the Best Deal Sourcing Program for Private Equity Analytics

So, where do you start if you want to implement data science in private equity? You need the right software solution. When choosing deal origination software, consider the following features.

Data Collection and Storage

The software should be able to collect and store information from various sources in one centralized location so you can easily access all the data you need for analysis. Machine learning that enhances data collection should allow you to gather more relevant data with less effort.

AI-driven Data Analysis

The platform should be able to analyze the data and generate insights quickly. But speed is only part of the equation. The program should be able to pick out patterns or trends and generate reliable predictions accurately; AI and machine learning make this possible.

Social Proof

Pick a program that has a proven track record of success. Read reviews from other users and look for case studies or testimonials to understand how the software works. Not all companies are created equal, so it’s important to use a reputable solution. However, technology is always evolving, so don’t write off digital innovations simply because they’re new.

Unlock Your Alternative Data Private Equity Potential With udu

By using the right data analytics solutions, private equity firms can leverage the insights generated by data science to make better decisions, find attractive deals faster, and use resources more efficiently. With these capabilities, investors can gain a competitive advantage.

If you’re ready to take advantage of data science in private equity, udu has the solution.

As a leading platform for private equity deal sourcing and origination, udu is changing how investors uncover deals by leveraging AI-driven data analytics. With udu, you can easily access actionable insights and use them to make smarter investment decisions.

Schedule a demo to see how udu is revolutionizing the way firms approach data science.