How Does Private Equity Work?

Ever wondered, “How does private equity (PE) work?” After reading this blog, you’ll understand everything you need to know about private equity. Here’s what you can expect to learn:

- How private equity works

- Popular PE investment strategies

- How PE firms generate proprietary deal flow

- How to improve deal sourcing with udu

Keep reading to learn everything about private equity.

Understanding How Private Equity Works

To understand the intricacies of working with private equity firms, you must first understand the basics: How does private equity work?

At its core, private equity refers to high-net-worth individuals (HNWI) and firms that invest capital into companies that aren’t publicly traded in exchange for an equity ownership stake. The motivation for these acquisitions is to achieve a positive return on investment (ROI).

First, PE investors raise capital from limited partners (LPs) to form a fund. Once the fundraising goal is met, they invest those funds into companies they believe have the potential for significant value creation. PE funds often target niche sectors or invest based on where a company exists in its lifecycle (e.g., new businesses with promising futures).

The main reason why private equity firms buy companies is to increase the value of their investments over time and eventually sell them at a higher price, reaping a profit. While there’s undoubtedly risk involved, the potential rewards tend to outweigh them.

Can private equity firms invest in public companies? Yes. On occasion, PE firms acquire public companies with plans to take them private.

To better understand how private equity works, let’s break down everything you need to know about private equity into three foundational stages: investment, growth, and exit.

- Investment: In this first phase, a PE firm makes an initial investment into a business, giving it a stake in the company (minority, equal, or majority) in return.

- Growth: After investing, the PE firm works with the target’s management team to strategically grow the business.

- Exit: The average hold time on a PE investment is five years, after which point the firm sells its stake in the company, ideally making a profit.

In the next section, we focus our attention on the investment stage.

2 Popular Private Equity Investment Strategies

There are certainly more than two PE investment strategies, but leveraged buyouts (LBOs) and growth capital investments are very common.

Leveraged Buyouts

In an LBO, a PE firm finances the acquisition of another company through debt, which is collateralized by the assets of the target company. LBOs enable PE firms to make large acquisitions while investing a smaller amount of capital upfront. The use of leverage augments the firm’s expected returns.

Growth Capital

Growth capital is a type of PE investment in companies with high-growth potential at more mature stages of their lifecycle. These invested funds are mainly used to finance company growth rather than for shareholder liquidity. These companies typically require capital to expand, restructure, and enter new markets. In short, growth capital is used to accelerate growth in more established companies, often without a change of control.

3 Ways PE Firms Generate Proprietary Deal Flow

Proprietary deals occur when a single investor has the opportunity to acquire or invest in a company before anyone else. Proprietary deal flow is an industry term that describes how a PE firm finds investment opportunities. There are three ways a private equity firm generates deal flow, which we discuss below.

1. In-person networking

Building strong, personal relationships in the industry has historically been the most effective strategy for securing proprietary deal flow. However, this method requires a significant amount of time and effort with no guarantee.

2. Outbound business development

Firms may also employ outbound prospecting by leveraging market databases and private company intelligence tools. Proprietary deals are unlikely to surface with this strategy since most firms have access to the same private equity databases.

3. Advanced technology

Today’s most effective deal sourcing strategies leverage AI-powered tools and data analytics. Modern technology such as artificial intelligence (AI) enables PE firms to uncover proprietary opportunities more efficiently than humans, saving both time and money.

Without a reliable proprietary deal flow source, a PE firm will be limited in its pursuit of uncontested investment opportunities.

Improve Deal Sourcing Efforts Using udu

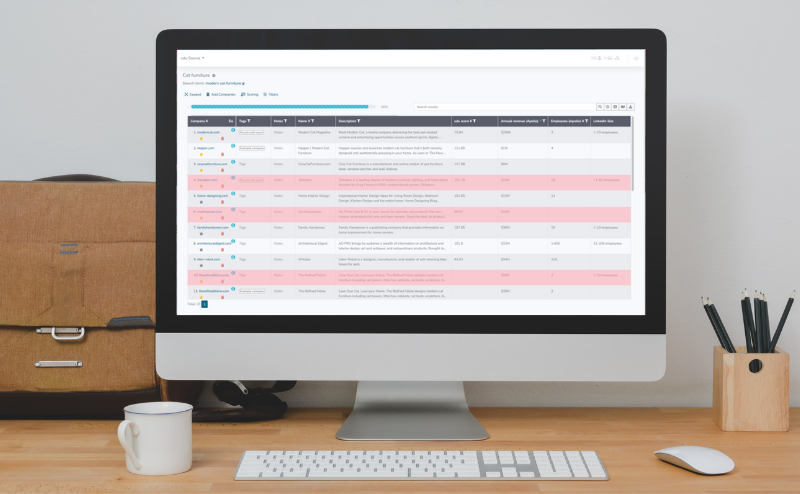

Now that we’ve covered everything you need to know about private equity, it’s time to begin deal sourcing using advanced technology. Our proprietary deal sourcing tool, udu, helps private equity firms identify acquisition opportunities that the competition missed.

- Speed: Patented data harvesting finds results faster than humans.

- Coverage: Increase the scope, scale, and depth of searches.

- Precision: Algorithmic scoring targets results that match your criteria.

- Support: Our team of experts can help you learn how to best use udu.

udu creates proprietary data resources to inform decision-making at all levels of your organization. If you want to stop relying on inconsistent, manual deal sourcing strategies, request a demo of udu today.