The Importance of Machine Learning in Private Equity

Identifying potential investment opportunities within a crowded market can be a challenging task. VC and private equity funds raised $405 billion through Q3 of 2022, on top of $695.6 billion raised in 2021, leaving firms with a ton of capital to invest in the most promising businesses.

PE firms are constantly looking for new ways to gain an edge in the market. One of the most effective yet underutilized strategies is leveraging data science and machine learning for private equity. Machine learning has revolutionized many aspects of business, from customer service to finance, and private equity deal sourcing is no exception.

By harnessing the power of machine learning, private equity firms can access a wealth of data-driven insights derived from analyzing large datasets. For example, machine learning can uncover trends and patterns in the stock market that would have been impossible for humans to detect on their own.

Using data science in venture capital and private equity isn’t necessarily new, but the prospects of machine learning have drastically increased the potential for investors. Read on to learn more about how private equity and venture capital firms are setting themselves apart from the competition through the use of artificial intelligence.

What is machine learning for private equity?

Machine learning traces back to the 1950s and has become one of the most popular methods for analyzing large datasets. The first computers that focused on learning were used to evaluate specific problems in biology and economics. Over time, this technology has grown in complexity and scope, eventually becoming relevant to virtually any industry.

Private equity firms now use machine learning to quickly analyze and break down massive amounts of data, leading to more accurate predictions and investment decisions.

Is machine learning the same as private equity artificial intelligence?

The words “machine learning” and “artificial intelligence” are often used interchangeably, but they actually refer to different technologies. Machine learning is training a computer algorithm on data that it can use to make predictions, while artificial intelligence (AI) is a computer program designed to mimic human intelligence.

While both AI and machine learning have the potential to be incredibly beneficial to private equity firms, they each offer different benefits. For instance, in private equity, artificial intelligence can work to solve issues such as:

- Optimizing stock portfolios

- Predicting market volatility

- Detecting anomalies

On the other hand, machine learning can provide this same analysis as well as more complex tasks, including:

- Pattern recognition of market trends

- Identifying new investment opportunities

- Developing risk mitigation strategies

When it comes to using data science in venture capital, the key is to understand each tool and how it can best be used to take advantage of potential opportunities in tandem. In addition, when using machine learning, venture capital firms can make more informed decisions and accurately predict trends in particular markets.

The benefits of machine learning for private equity over traditional methods

To be successful, private equity firms must be able to identify and capitalize on emerging trends in the market quickly. Machine learning makes this task much simpler by providing a more efficient way of analyzing and processing large amounts of data.

Here are just a few of the ways that machine learning can benefit private equity firms:

Increased accuracy in market analysis and prediction

In private equity, learning how to read and analyze markets correctly is key to making profitable investments. Traditionally, this required analyzing and interpreting data manually, which can be tedious and time-consuming. Machine learning algorithms eliminate human limitations. Removing manual errors from the process allows firms to analyze data with precision and accuracy.

Time-efficient analysis of complex datasets

Another benefit of machine learning in private equity is its ability to process large amounts of data quickly. This allows investors to assess hundreds or even thousands of potential investments in a fraction of the time it would take to evaluate them manually. Using machine learning, private equity firms can scan vast amounts of data, detect patterns and trends, and make more informed decisions based on their analysis.

Improved risk management

As with any investment, there is always a degree of risk associated when investing in a company. Traditionally, firms would analyze the risk of an investment on a case-by-case basis. However, machine learning algorithms can provide a more accurate and comprehensive approach to risk analysis by automatically detecting patterns that may be considered red flags.

By leveraging these insights, machine learning for private equity could help firms identify and mitigate potential risks associated with an investment before committing capital.

What to look for in a machine learning for private equity and venture capital platform

With these benefits in mind, the next step is to find a software solution that enables your firm to make the most of machine learning and AI. Here are some key features to look for when selecting a private equity deal sourcing platform:

AI capabilities

The most important factor to consider is the level of AI capabilities offered by the platform. As discussed above, not all AI is machine learning, but the best machine learning uses AI to enhance its performance.

Look for a solution that includes sophisticated analytics tools, predictive models, and intelligent automation features that enable your firm to quickly and accurately analyze data and uncover hidden signals. These capabilities should be tailored to the private equity industry and must be able to scale with your firm as its needs evolve.

Data sources

The machine learning platform you choose should have access to a wide range of data sources, including both traditional and alternative data sets relevant to the private equity industry. These may include qualitative data, news media analysis, social media insights, and industry trends.

Deal origination and portfolio management

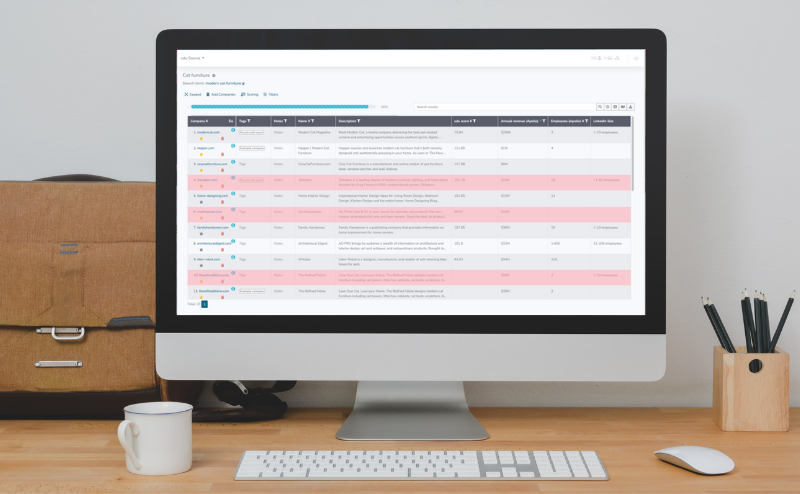

A machine learning platform should provide your firm with the ability to quickly and efficiently source deals and manage and monitor your portfolio. Look for platforms that offer advanced search capabilities, automated deal flow processes, and portfolio monitoring tools while providing a seamless user experience.

Support

Finally, look for a solution that comes with comprehensive customer support. This will help you quickly get up to speed with the platform and easily make any changes or adjustments that may be needed. When your firm can lean on a trusted support team, you can rest assured that your deal sourcing strategy is in good hands.

Unlock the power of private equity artificial intelligence with udu

Machine learning for private equity is rapidly becoming a powerful tool that can provide unprecedented insights into investment opportunities and risks. By leveraging the capabilities of machine learning platforms, investors can make more informed decisions faster than ever before, ultimately helping them to maximize their returns.

However, choosing the right platform for your firm’s needs is crucial. At udu, you can trust that our platform offers all the features your firm needs to take full advantage of machine learning and AI, from sophisticated analytics to AI-driven data harvesting that can help you uncover hidden opportunities and mitigate risk.

udu is a platform that helps private equity teams solve the most complex problems and make data-driven decisions with confidence. Schedule a demo of udu to see how machine learning and AI can help you unlock the power of data science in venture capital and private equity.