Can Artificial Intelligence Revolutionize the Private Equity Industry?

Introduction

Would you believe us if we told you that artificial intelligence (AI) is as old as private equity (PE), but PE firms have only recently began to leverage the benefits of its use?

Both industries have come a long way to be part of our everyday lives today. PE got its start with the first venture capital firms in the 1940s, and leveraged buyouts came into vogue beginning in the 1950s.

” AI is a part of our everyday lives”

Similarly for AI, the first work in the field is widely recognized as McCulloch and Pitts’ formal design for Turing-complete “artificial neurons” in the 1940s. Research was heavily funded in the following decades, and today AI is a part of our everyday lives that has transformed a wide range of industries including transportation, healthcare and manufacturing.

That said, there are still lots of white spaces for both industries and endless possibilities for the two to work together. Eventually, we believe that every company will have to become a technology company and master the use of AI to thrive in today’s digital era.

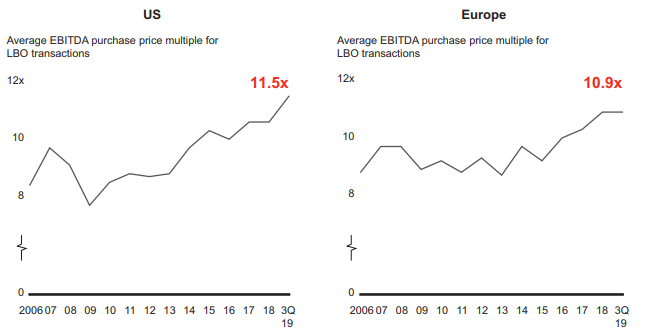

The PE industry today

When we look at the PE landscape today, there are several megatrends that have developed over the past decade. The first trend is significant and growing competition. Preqin’s research has found that over 18,000 fund managers offered a private equity product in 2018. In 2019, Bain & Co also estimated that dry powder for the industry as a whole stands at USD 2.5 trillion. Investors are seeking yield in a world where interest rates are depressed and the number of public companies in the US has halved from over 7,300 in 1996 to 3,600 in 2016. As a result, more money is moving into PE vehicles and increasing the competition and therefore the price for assets. This trend is borne out in the numbers, with average EBITDA multiples for LBO transactions reaching all-time highs of 11.5x in the US and 10.9x in Europe as shown in the following chart.

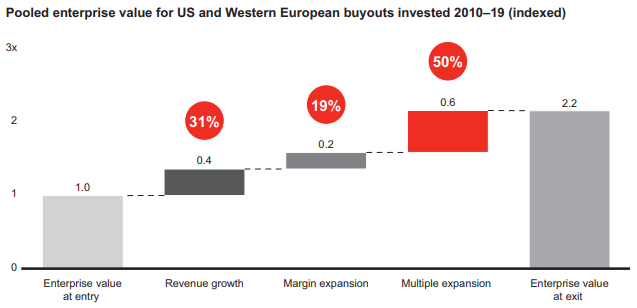

A second trend, also exacerbated by the increased competition, is a lack of opportunity to identify and acquire companies that can be significantly improved operationally. Bain & Company found that ~50% of buyout deal returns in the US and Western Europe from 2010-2019 actually came from multiple expansion. This lies in contrast to the marketing claims of many General Partners (GPs) today, which state that they are active managers who create value primarily through operational improvements.

Notes: Includes fully realized buyouts with at least $50 million in invested capital and initial investment made January 1, 2010, to October 30, 2019; analysis based on 429 deals for which operational data is available

A third trend that has developed is the tendency for limited partners (LPs) to increasingly consolidate their capital with a smaller number of GPs. This trend means that large GPs will continue to get larger while small sector specialists will always be in demand. The result is that the generalist, middle market funds of yesteryear will face increasing competition for capital allocation from LPs.

In short, to maintain easy access to capital a PE firm either needs to have significant critical mass or to be the best in a small defined niche, which is much easier said than done. Despite these challenges, we believe that PE firms can leverage AI technology to differentiate themselves and ultimately succeed in a competitive marketplace.

The essence of AI

So, what is AI and what can it do for you?

There are two types of AI – weak/narrow AI, and strong/general AI. As the name suggests, narrow AI refers to intelligent systems that carry out specific functions that we have built them to perform. Narrow AI has already been embedded in our everyday lives, with applications ranging from Apple’s Siri voice recognition to industrial robots on the factory floor.

General AI, on the other hand, is the kind of adaptable intellect that humans possess. Instead of being specifically instructed, General AI can learn how to do unfamiliar tasks through the use of logic and knowledge learned from other domains. This is unfortunately, or fortunately depending on your viewpoint, not yet a reality today.

“Cost reductions come from the reduction of much of the manual work and inefficiencies”

That said, narrow AI already offers a plethora of benefits that will allow PE firms to stand out in a crowded marketplace. Narrow AI offers a firm the ability to produce higher quality results using a rigorous data-driven approach at much lower costs and at much faster speeds. Cost reductions come from the reduction of much of the manual work and inefficiencies in various aspects of a firm’s operations including deal sourcing, due diligence accounting and hiring. These efficiencies also allow a firm’s resources to be focused on only the most high-value activities, helping to create opportunities not accessible to less tech-savvy competitors.

Some simple examples of AI-driven value creation opportunities include being able to: (i) sift through large, alternative datasets to find unique investment themes and opportunities effectively and quickly, (ii) help portfolio companies in traditional industries transform digitally and gain a competitive advantage, (iii) use real time analytics to monitor portfolio companies and their industries and (iv) extract macro insights that can be applied across all portfolio companies. For more, check out this article on how AI can improve the three core capabilities of your PE firm.

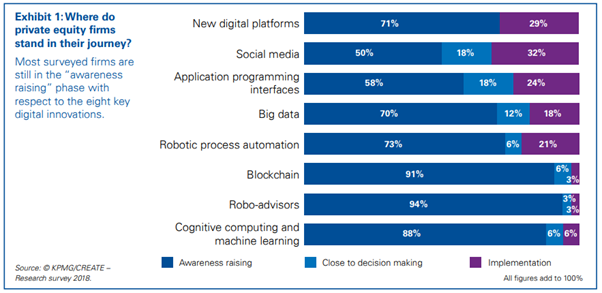

Most importantly, a real opportunity exists for PE firms who move quickly to gain a significant advantage in the marketplace through technological innovation. According to a survey done by KPMG in 2018, 70-90% of surveyed PE firms are still in the awareness phase with respect to eight key digital innovations, as shown in the next chart.

By mastering technology and AI, a PE firm can stand out amongst a crowded field of competitors in the eyes of both LPs and potential portfolio companies.

The post COVID-19 world

Besides the here and now, the COVID-19 pandemic makes us ponder what a post COVID-19 world will look like.

” we believe that every company will need to be a technology company going forward “

As the only sector in the S&P 500 index that has a positive YTD gain (as of May 28, 2020), we can all agree that the technology sector will likely emerge as one of the winners as the pandemic shifts our economic landscape. In fact, we believe that every company will need to be a technology company going forward.

There are of course several themes and white spaces for technology to grow, and these are still early days. The one theme that we strongly believe in is automation through AI.

Why is the case? When cities went on lockdowns globally, many traditionally offline businesses were forced to migrate online and adopt new technologies. Many realized that simple automation technology (e.g. accounting software, automated invoicing, real time alerts, etc.) can help to cut many inefficiencies from the system. Not only does this mean that operating costs can be reduced, but also that resources can be conserved and focused on more important things. Many companies will be coming out of the pandemic with more debt than before, and automation will be a key lever in helping to repair those balance sheets. If you are a GP known for using its tech prowess to help portfolio companies increase productivity and reduce cost, wouldn’t you become a favored partner for them?

Secondly, automation and AI not only improve business performance but can also be used as a form of business continuity planning (BCP). When the next challenge comes, be it due to a pandemic or some other exogenous factor, companies must be ready to continue operating even when humans are unable to do so.

Conclusion

In summary, not only do we believe that AI is already revolutionizing the private equity industry, we believe the use of AI will be essential for long-term success in the digital era.

If you would like to learn how udu is helping firms and their portfolio companies bridge the technology gap and gain a significant competitive advantage through the use of AI, please visit us at udu.co or contact us at info@udu.co